You can stop living paycheck to paycheck

Not with a budget - with a cash plan

Not with a budget - with a cash plan

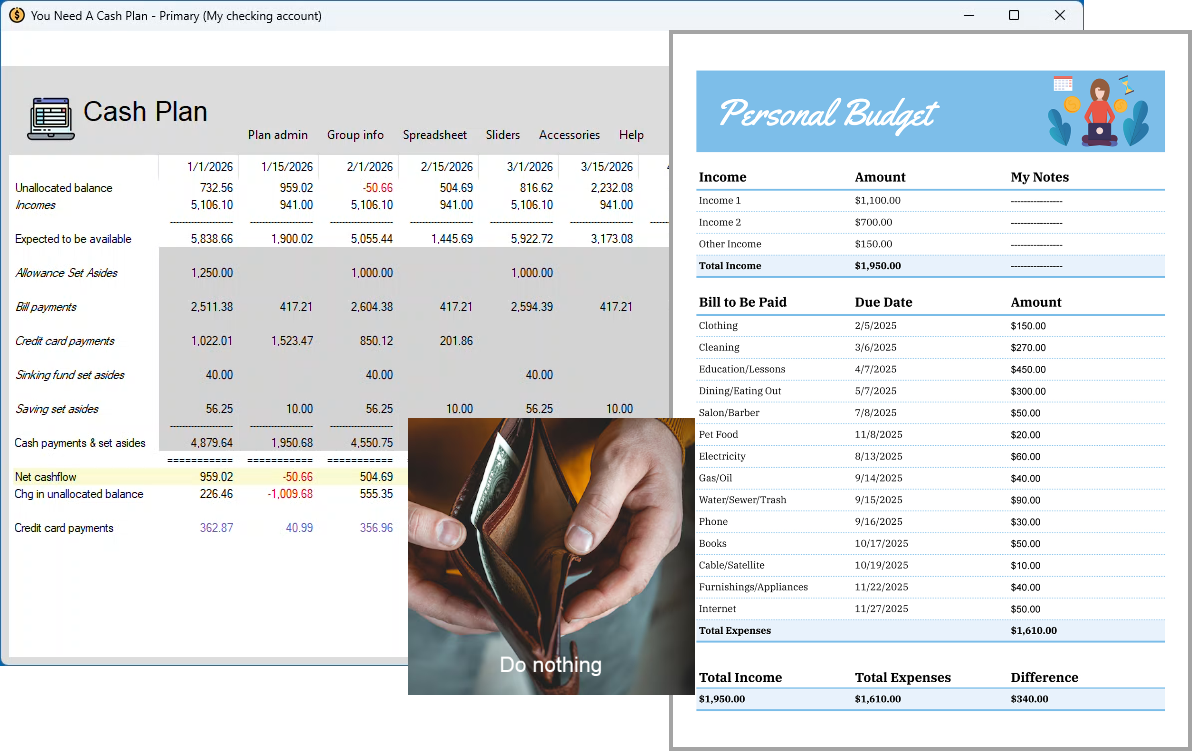

You Need A Cash Plan is a cashflow awareness system. Instead of predicting how you should spend, it shows you how your money will move in the coming months. Its purpose is clarity, prevention, and peace of mind.

Stress free.

A personal budget is a planned allocation of money for a month or payday. It shows where you expect your income to go and how much you're “allowed” to spend in each category. It’s built for organization and discipline.

Stressful to maintain.

Without a system, your money becomes reactive instead of proactive. You rely on memory, gut feelings, or checking your bank balance and hoping it lasts.

High stress.

Projects your future net cashflow automatically, highlighting exactly when cashflow is going to dip negative. You keep up with changes as they happen. You Need A Cash Plan constantly adjusts as life changes.

Automatic

You sit down once a month, list expected bills, create categories, and assign amounts. But the moment life changes (car repairs, a surprise bill, fluctuating income) your budget is no longer accurate unless you go back and update it.

Choose a budgeting method (50/30/20 rule, zero-based, envelope system, etc.) and a budgeting tool

You check your bank account balance to guess if you can afford something. You make decisions moment-to-moment instead of seeing consequences ahead of time. Small missteps snowball.

???

* Cash flow timing

* Anxiety about upcoming bills

* Living paycheck to paycheck

* Uncertainty about when money will run out

* Overspending caused by lack of clarity

* Controlling spending

* Management of credit card usage

* Automating long- and short-term sinking funds, savings, and investments

* Timely balancing of bank statements and reconciling of credit card statements

* Creating custom debt payoff plans

* Playing "what if?" with any aspect of your cash flow

* Maintaining net worth and debt-to-income ratio

* Exchanging cash plans within families and with financial advisor clients

It’s designed for real-life unpredictability

* Planning and organization

* Overspending on categories

* Long-term goal setting

But it does not solve timing, the biggest struggle for paycheck-to-paycheck households

* You run out of money before payday

* Bills surprise you

* You rely on credit cards to fill gaps

* You constantly feel behind

* Financial stress becomes normal

* You lose opportunities to save because everything feels urgent

Doing nothing equals financial drift

* Zero guilt

* Zero restriction

* Creates calm because the future is visible

* Builds confidence through clarity

* Especially helpful for people with irregular income or unpredictable lives

* Can feel restrictive

* Leads to guilt when you "break" it

* Creates frustration when unexpected expenses ruin your plan

* Works best for people who are already stable or disciplined

* High anxiety

* Money confusion

* Feelings of failure when bills stack up

* Constant stress around payday

* No sense of control

* Emotional fatigue from "winging it" every week

You stay on track because the system updates itself and reflects real life. You avoid negative cashflow, avoid overdrafts, reduce credit use, and build savings naturally because you can see the timing of money clearly.

Helps you prepare

Good if maintained, but you often quit because it requires discipline and constant adjustments. When abandoned, the financial situation usually reverts to chaos.

Helps you plan

Money leaks everywhere. Emergencies become crises. You spend based on mood instead of reality. Saving rarely happens intentionally. Debt becomes a lifeline.

Leaves you guessing

You Need A Cash Plan helps households by giving them a simple, modern way to see exactly how much money is coming in, going out, and what’s left for the next twelve months. It replaces stress and guesswork with clarity. Families can make decisions with confidence, stay on the same page financially, and finally feel in control of their cash flow without complicated budgeting or spreadsheets.

You Need A Cash Plan helps teach personal finance by giving students a clear, hands-on way to see how cash flow really works. Instead of abstract lessons, learners can practice projecting income, expenses, and what’s left to build real-life money skills that they can use immediately. It makes financial education simple, visual, and practical for any age group.

You Need A Cash Plan helps financial advisors by giving clients a simple, visual way to understand their future net cashflow. Instead of guessing where their money is going, clients come to meetings prepared, aligned, and more confident. Advisors save time, reduce repetitive budgeting conversations, and can focus on higher-value planning because clients finally have a clear, consistent cashflow system they can use at home between sessions.

When planning a path out of debt

You Need A Cash Plan helps you see where your money really goes so you can take control, stop falling behind, and start paying down debt with confidence. You have calculators with which you can create custom payoff plans for one debt, a debt snowball, and amortizing a high balance on a credit card.

You Need A Cash Plan has an Advance Plan feature that helps couples see their full financial picture before they say “I do.” It makes it easy to talk about money, combine plans, and build confidence in how you’ll handle expenses together after the honeymoon.

You Need A Cash Plan strengthens the Financial Fitness Mentor Program by giving participants a simple, practical tool to manage their monthly cashflow. Mentors can focus on guidance instead of spreadsheets while participants gain real clarity, build confidence, and practice healthy money habits between sessions. You Need A Cash Plan makes coaching easier, progress faster, and financial transformation far more sustainable.

Real benefits of using You Need A Cash Plan

You Need A Cash Plan is simple, practical software that automatically organizes your income around real life, not artificial categories or spending rules.

A key aspect of using You Need A Cash Plan is how little of your time is needed. With the program doing the heavy lifting, your involvement in managing your income is greatly reduced compared to maintaining a budget.

Click here for an in-depth comparison of You Need A Cash Plan vs. budgeting.

* Real-time clarity

* Focuses on actual cash flow

* Works for variable income and real-world spending

* Easy to adjust and far more forgiving than budgets

* Good for planning and organization

* Often rigid, hard to maintain

* Fails when income or expenses fluctuate

* Gives structure but not real-time insight

* No visibility

* Easy to overspend without realizing

* Creates stress and confusion

* Leads to repeating money problems