Reinventing the way you manage your money.

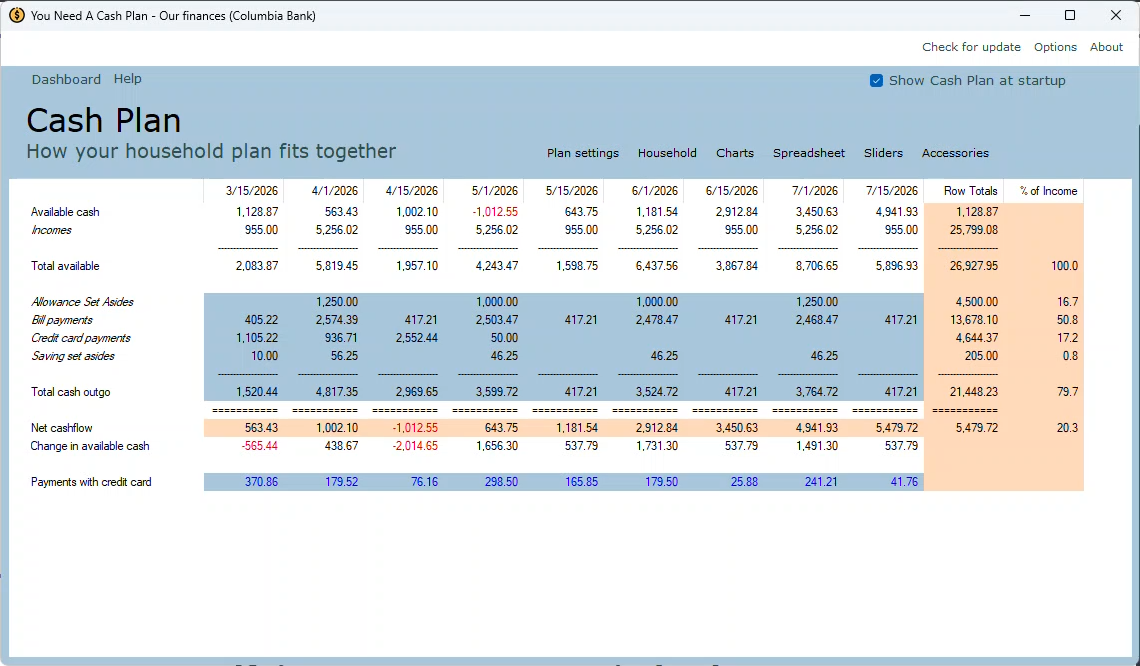

You Need A Cash Plan organizes your income, spending, bills, credit cards, and savings into a simple timeline so you can see clearly when your money will be happening.

You Need A Cash Plan organizes your income, spending, bills, credit cards, and savings into a simple timeline so you can see clearly when your money will be happening.

You already understand the pieces of your financial life. You know your paycheck, bills, spending habits, and the obligations that come due each month.

The difficulty is seeing how all of those pieces fit together.

Nothing about your system is broken.

It’s simply hard to see clearly.

Every household operates within a simple financial system.

The challenge is that most financial tools only show pieces of this system—a bank balance, a budget category, or a list of past transactions.

What they rarely show is how money moves through time.

When you can see both when your money happens and where it will be going, your entire financial picture becomes clearer.

You Need A Cash Plan does not ask you to adopt a new lifestyle just for managing your money the way budgeting does. Instead, it organizes what you are doing right now into a simple, visual structure.

Instead of flying blind with you money, you can clearly see what is, and will be happening.

You stop reacting to money.

You begin directing it.

You Need A Cash Plan works for everyone—whether a household earns a little, a lot, or something in between—because it focuses on timing, not wealth. By mapping out when money comes in and when it needs to go out, You Need A Cash Plan gives every person a clear picture of their cash flow, allowing them to make confident decisions, reduce stress, and stay in control.

It’s not about having “extra” money; it’s about seeing the rhythm of the money you already have and using it with intention.

You Need A Cash Plan works with any income type, payday schedule, or mix of earnings because it’s built around real-world cash flow. Whether income arrives weekly, biweekly, monthly, irregularly, seasonally, or from multiple sources, You Need A Cash Plan simply places each deposit on the timeline and shows exactly how it supports upcoming bills, spending, and savings.

No matter how complex the income pattern is, You Need A Cash Plan brings clarity by letting the timing of your money tell the story.

With You Need A Cash Plan, you stay in control of everyday spending by giving yourself a weekly allowance: on the day you choose and in the amount you choose. This simple rhythm creates structure without restriction, ensuring your essentials are covered while giving you a predictable, judgment-free pool of money for groceries, gas, and daily life.

You decide the schedule, you decide the number, and You Need A Cash Plan keeps everything aligned with your bigger cash-flow plan.

You Need A Cash Plan works with any type of bill, on any payment schedule, in any combination because it organizes them by timing rather than category. Whether your bills are monthly, quarterly, annual, fixed, variable, or scattered across multiple due dates, You Need A Cash Plan places each one on your cash plan so you always see what’s coming and which income covers it.

No matter how complex the mix, the cash-flow view in You Need A Cash Plan keeps everything predictable and manageable.

You manage your credit cards in You Need A Cash Plan using a clear four-step method that keeps you organized and in control. First, you keep receipts or reminders of every authorized charge. Second, you enter new activity into your cash plan and adjust scheduled payments so you instantly see the impact on cash flow. Third, you reconcile each monthly statement to confirm every charge and catch fraud quickly. And fourth, you pay the full statement balance on time—ideally with automatic payments—to avoid all interest and fees.

You use sinking funds in You Need A Cash Plan to help you “save up” for future purchases by setting aside small amounts of money over time. Whether the goal is short-term—like new tires or Christmas gifts—or long-term, such as a vacation or a down payment, You Need A Cash Plan automatically maintains each sinking fund once it’s set up and shows how each contribution affects your cash flow.

By treating these set-asides as expenses, You Need A Cash Plan makes future needs visible today so you’re always prepared when the time comes.

Savings in You Need A Cash Plan are designed to help you set aside today’s income for tomorrow’s needs, giving every household a simple way to prepare for both expected and unexpected expenses. Savings can be short-term—like emergency funds, periodic expenses, or ongoing costs—or long-term, such as retirement, investing, or building an unemployment reserve. Each type of savings can be funded in different ways: as a percentage of income, a fixed amount on a schedule, or only when extra money is available.

You Need A Cash Plan treats savings as an expense so your cash-flow plan always shows what’s truly available to spend, while still helping you build the future you want.

You Need A Cash Plan helps households by giving them a simple, modern way to see exactly how much money is coming in, going out, and what’s left for the next twelve months. It replaces stress and guesswork with clarity. Families can make decisions with confidence, stay on the same page financially, and finally feel in control of their cash flow without complicated budgeting or spreadsheets.

You Need A Cash Plan helps teach personal finance by giving students a clear, hands-on way to see how cash flow really works. Instead of abstract lessons, learners can practice projecting income, expenses, and what’s left to build real-life money skills that they can use immediately. It makes financial education simple, visual, and practical for any age group.

You Need A Cash Plan helps financial advisors by giving clients a simple, visual way to understand their future net cashflow. Instead of guessing where their money is going, clients come to meetings prepared, aligned, and more confident. Advisors save time, reduce repetitive budgeting conversations, and can focus on higher-value planning because clients finally have a clear, consistent cashflow system they can use at home between sessions.

When planning a path out of debt

You Need A Cash Plan helps you see where your money really goes so you can take control, stop falling behind, and start paying down debt with confidence. You have calculators with which you can create custom payoff plans for one debt, a debt snowball, and amortizing a high balance on a credit card.

You Need A Cash Plan has an Advance Plan feature that helps couples see their full financial picture before they say “I do.” It makes it easy to talk about money, combine plans, and build confidence in how they’ll handle expenses together after the honeymoon.

You Need A Cash Plan strengthens the Financial Fitness Mentor Program by giving participants a simple, practical tool to manage their monthly cashflow. Mentors can focus on guidance instead of spreadsheets while participants gain real clarity, build confidence, and practice healthy money habits between sessions. You Need A Cash Plan makes coaching easier, progress faster, and financial transformation far more sustainable.

You Need A Cash Plan is simple, practical software that automatically organizes your income around real life, not artificial categories or spending rules.

A key aspect of using You Need A Cash Plan is how little of your time is needed. With the program doing the heavy lifting, your involvement in managing your income is greatly reduced compared to maintaining a budget.

Click here for an in-depth comparison of You Need A Cash Plan vs. budgeting.